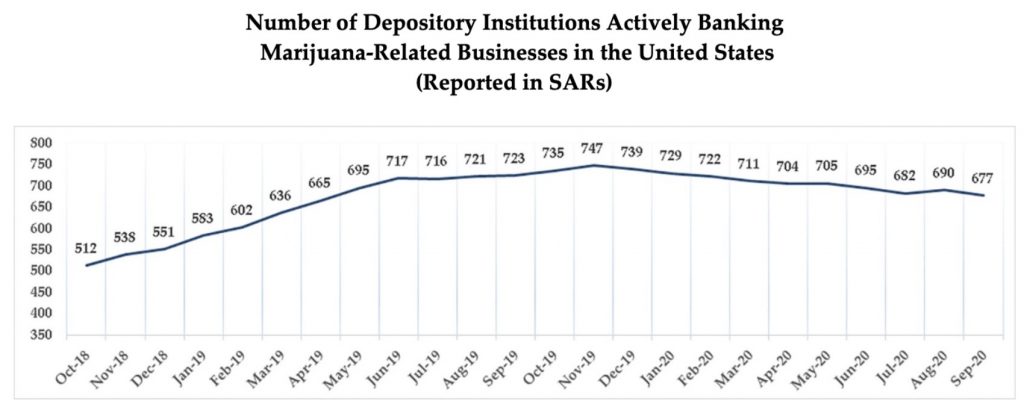

While the cannabis industry remains consistently optimistic about banking access, new data from the Financial Crimes Enforcement Network (FinCEN) says banking access has dropped. For three consecutive fiscal quarters, the number of financial institutions that report serving state-legal cannabis businesses has fallen, from 711 banks to 695 to 677 — all the while, cannabis has generated booming tax revenues. Is COVID affecting banking access, too?

Image courtesy of FinCEN

At the end of last quarter, there were 502 banks and 175 credit unions that reported active cannabis-industry clients. Most states with legal cannabis allowed businesses to continue to operate in the ‘essential services’ category during COVID restrictions that shut down other companies.

What’s the status, Gladys? The rationale, it turns out, isn’t quite what it seems to be. The trend doesn’t mean banks don’t want to do business with the cannabis industry. A big piece of the pie is related to a change involving hemp firms. FinCEN, part of the Treasury Department, changed the Suspicious Activity Report (SAR) requirements. Additionally, some cannabis-related businesses may have just closed during the pandemic; or staffing shortages at financial institutions have reduced the resources available to process SARs.

Stemming from the 2014 Obama administration, all banks (and credit unions, too) must submit SARs if they provide service to cannabis businesses. The number of financial institutions was climbing after that. Still, the recent dip was an about-face to that upward trend. And, funny enough, it might not be a drop at all. The timing of the SARs filings might be influential. “Short-term declines in the number of depository institutions actively providing banking services to marijuana-related businesses (MRBs) may be explained by filers exceeding the 90-day follow-on Suspicious Activity Report (SAR) filing requirement,” FinCEN said. “Several filers take 180 days or more to file a continuing activity report. After 90 days, a depository institution is no longer counted as providing banking services until a new guidance-related SAR is received.”

Hemp-only businesses were excluded from quarterly reports and may partially account for the drop. After all, earlier figures included hemp-related accounts. Hemp was legalized by the feds in the 2018 Farm Bill.

There’s still hope for the cannabis industry to garner access to widespread banking access. Many advocates are hedging their bets on the Biden-Harris administration. While the House has managed to pass the SAFE Banking Act no less than three times over the last tumultuous year, both as a standalone bill and commingled with COVID-relief legislation, there’s hope that the pending GOP chair of the Banking Committee would move the proposal through the process.