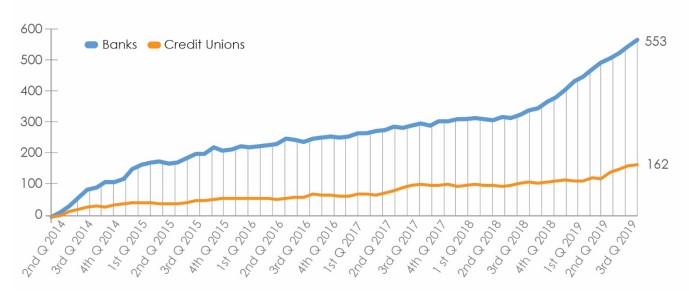

More banks and credit unions than ever are working with cannabis-related businesses, according to a recent federal watchdog report.

The Financial Crimes Enforcement Network (FinCEN) oversees all banking activity in the country looking for suspicious activity. And cannabis presents a problem for FinCEN — it is legal in some states but remains federally illegal, meaning banks could be accused of facilitating money laundering just for working with a state-licensed cannabis business. The risk, however, hasn’t stopped more financial institutions from opening their doors to cannabis.

At the end of June, there were 553 banks and 162 credit unions that reported to the federal government that they were providing services for cannabis-related businesses, according to the FinCEN quarterly report. FinCEN knows these banks are working with cannabis-related businesses because the banks and credit unions are telling them. To be able to work with cannabis-related businesses with the least amount of fear of penalty, banks and credit unions file suspicious activity reports (SARs) when they encounter certain kinds of activity, and that includes all cannabis business transactions.

Here’s a breakdown of what the report said:

- FinCEN received a total of 87,249 SARs using the key phrases associated with cannabis-related businesses,” according to the FinCEN report.

- About 78% were from state-licensed cannabis businesses.

- About 8% were targeted for further investigation.

- About 25% had their accounts terminated.

Some SARs had multiple FinCEN key phrases, which is why it totals more than 100%. That termination amount is high, but that’s still a majority of businesses that are allowed to receive banking services.

That may soon change. The House of Representatives recently passed the Secure and Fair Enforcement (SAFE) Banking Act to protect banks that provide services to cannabis-related businesses. This would clarify rules for regulators and make it much easier for more financial institutions to welcome cannabis business customers. U.S. Treasury Secretary Steve Mnuchin told Congress in April that the confusion for financial institutions wasn’t the fault of regulators, because they could only uphold existing regulation that did not clearly allow for cannabis-related business activity.

Regulators have been working off of the Cole Memo, which leaves many questions unanswered and not formally written into the rules. The Cole Memo was issued by U.S. Deputy Attorney General James Cole in 2013 and outlined to the U.S. Justice Department that it would not enforce cannabis prohibition. U.S. Attorney General Jeff Sessions later rescinded that memo, but not much has changed in practice. Even credit unions won’t be sanctioned for working with cannabis businesses anymore.

While more banks and credit unions are working with cannabis-related businesses than ever before, it is still not a majority and it is difficult for million-dollar businesses to get financial services. This has lead to large companies running on a cash-only basis and problems for the IRS when they try to collect taxes. Having large amounts of cash is a security risk and impacts the economy, which is part of why 38 attorneys general have endorsed the SAFE Banking Act.