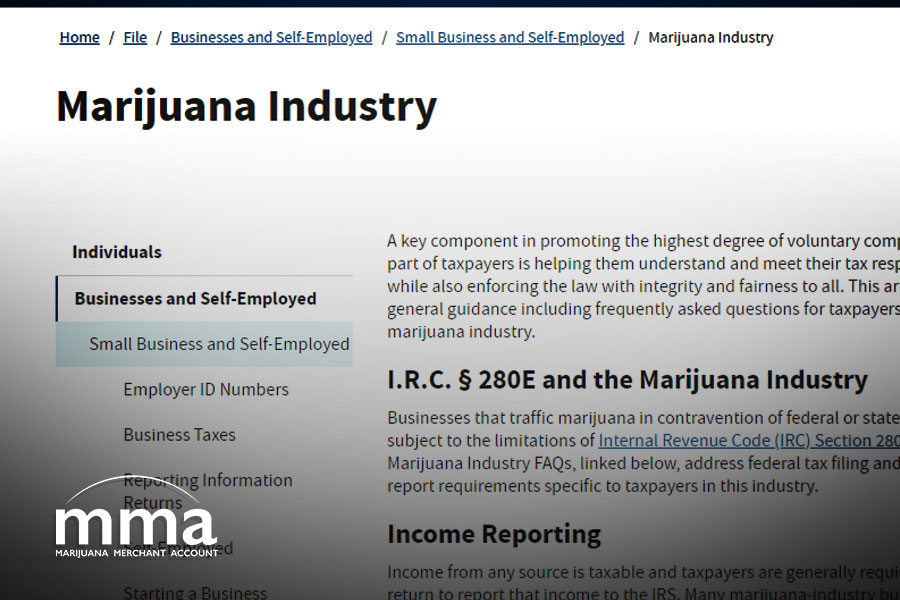

Number of Banks Working with Cannabis Industry Continues to Decline Throughout COVID, Federal Report Shows

While the cannabis industry remains consistently optimistic about banking access, new data from the Financial Crimes Enforcement Network (FinCEN) says banking access has dropped. For three consecutive fiscal quarters, the number of financial institutions that report serving state-legal cannabis businesses has fallen, from 711 banks to 695 to 677 -- all the while, cannabis has