“CASH ONLY.” That’s not a sign you see often in the digital age. It means more work for retailers (not to mention annoying your customers). But most cannabis businesses are operating on a cash-only basis out of necessity. Over 20 states have cannabis regulations, but federal law deters most banks from offering accounts to this blooming business. It’s not that banks are completely forbidden from working with marijuana companies. More and more do so every day. Financial institutions are, however, forced to monitor the accounts of cannabis companies closely to look for signs of money laundering or other money crimes. That kind of overwatch takes time and resources. Unless, of course, you have an app for that.

Enter Hypur, an innovative Arizona-based company launched in 2014 by a team of experts in banking, payments, and technology. They currently work with a handful of banks in Colorado and handle hundreds of millions of dollars in transactions. Hypur’s unique software platform makes it easier for banks to ensure cannabis businesses are legally compliant and operating with the required licenses.

The Hypur platform audits the cannabis company automatically so the bank doesn’t have to:

- Hypur starts by reviewing all of an applicant’s documents, such as local and state licenses, financial statements, leases, and other relevant documents.

- Hypur monitors compliance by connecting to a dispensary’s point-of-sale system and the state’s seed-to-sale system.

- If all looks in order, Hypur clears the business as operating legally, allowing the financial institution to work with them.

- Hypur creates automatic notifications regarding license expiration dates and other important matters for the institution.

Streamlining the approval process

This automated system makes it much faster for a financial institution to review and approve a new account for a cannabis business. Does that mean a dispensary could accept credit cards at their location? Well, not exactly. Credit card transactions are managed through giants like VISA or Mastercard, which will likely not budge from their cannabis ban until federal prohibition is lifted.

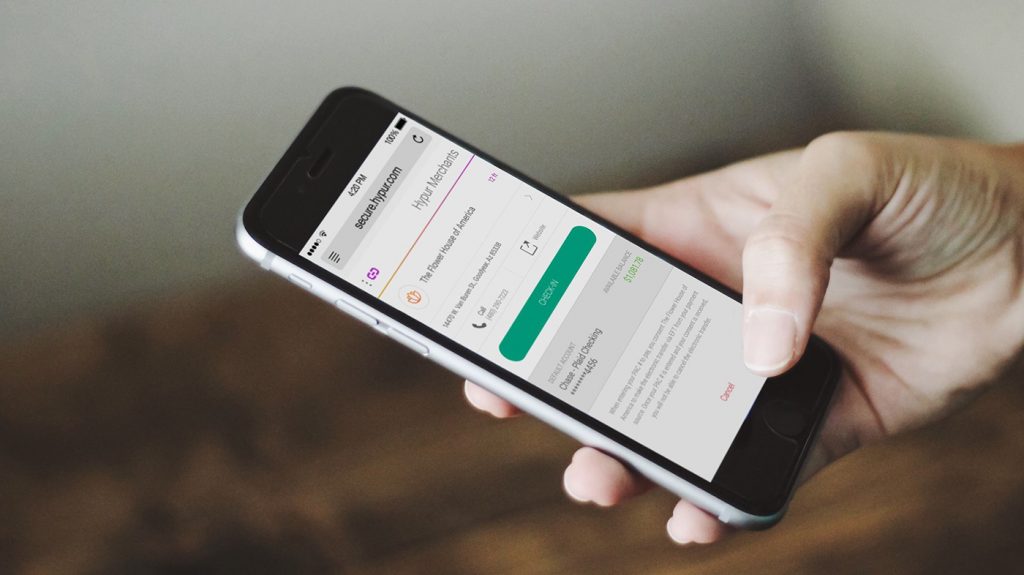

That doesn’t stop Hypur. Their founders would like to see the elimination of cash altogether and the risks that come with a high-cash business. Once a marijuana dispensary is approved by Hypur, the customers of the company are encouraged to download the Hypur app. After they set it up, customers can pay without cash by using Hypur’s platform to make a bank-to-bank transaction. This allows the bank to track transactions in and product out in a way like never before. Hypur considers this to be allowing banks to know their customer’s customer, a vital element of what sets them apart.

Without innovative services like Hypur, marijuana businesses must run the risk of operating solely on cash.

Reducing risks for cannabis businesses

Hypur seems to provide an effective method of reviewing a potential cannabis company’s information quickly for a financial institution. Even with billions of dollars flowing through the cannabis industry, 70 percent of cannabis companies don’t have a bank account. But 30 percent do, and trends show more are getting approved. Hypur, along with banks that are willing to open their doors to this lucrative, regulated market, are making it easier to do legitimate business, reducing the inherent risks that come with large amounts of cash, and making it easier for customers when they buy.