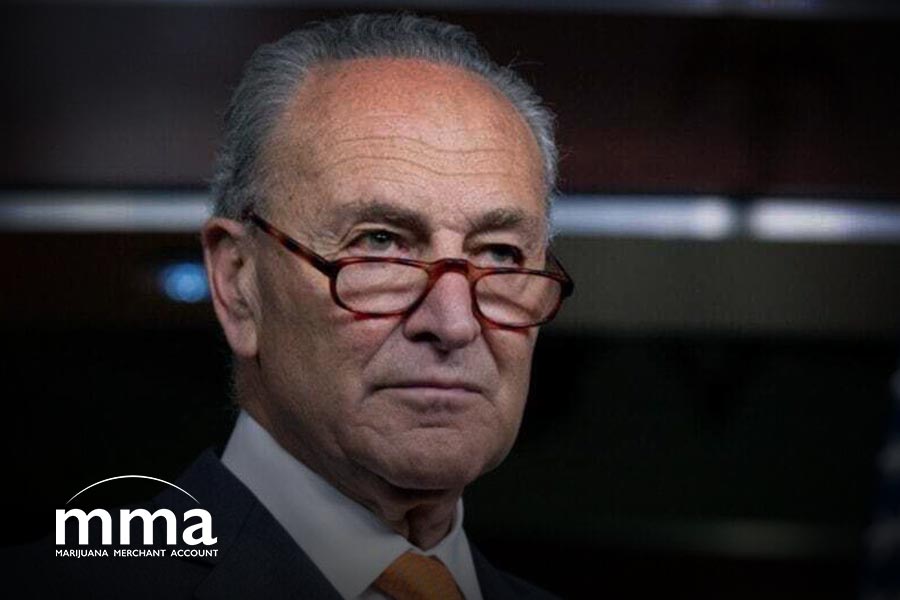

Senate Majority Leader Chuck Schumer said he and the two other senators behind a bill to federally legalize cannabis have an “agreement” in place not to advance marijuana banking legislation until they’ve passed their more substantive reform proposal.

Schumer, alongside Senate Finance Committee Chairman Ron Wyden (D-OR) and Sen. Cory Booker (D-NJ), is one of the co-sponsors of the Cannabis Administration and Opportunity Act (CAOA), which would remove marijuana from the federal list of controlled substances and establish the right of all states to set their own marijuana policies.

Schumer appeared on Drug Policy Alliance founder Ethan Nadelmann’s podcast Psychoactive to discuss the prospects of his marijuana legalization bill. Nadelmann also asked the majority leader why he’s yet to hold a vote in the Senate on the Secure and Fair Enforcement (SAFE) Banking Act, which would allow banks to offer services to state-legal cannabis businesses without fear of federal reprisals.

The bill has been approved by the US House of Representatives five times, including as an amendment to a defense spending bill passed earlier this month. Schumer said allowing piecemeal cannabis banking reform to pass before more comprehensive changes would ultimately slow down progress on full legalization, and that he, Wyden and Booker have consensus on this point.

“Senators Booker, Wyden and I have come to agreement that if we let [the banking bill] out, it’ll make it much harder and take longer to pass comprehensive reform,” Schumer said. “We certainly want the provisions, similar to the SAFE Banking Act, in our bill. But to get more moderate people—to get some Republicans, to get the financial services industry—behind a comprehensive bill is the way to go. It’s the right thing to do.”

Schumer had previously said he was “reluctant’ to advance marijuana banking before full legalization, while Booker had said he “will lay myself down” to block other senators from voting on it before it had voted on ending federal cannabis prohibition.

“All the pain that’s been suffered by so many people for so long will not be alleviated because banks can now do some funding of the growing and processing of marijuana,” Schumer added. “We think that the quickest way to get it all done is to do it together. If you let just the banking provisions pass, it’ll make it much harder to get more Republicans and more conservatives on the bill.”

However, Schumer said he is open to the idea of advancing cannabis banking reform into the Senate’s defense spending bill so long as social equity provisions are also included, such as expungements for prior marijuana convictions.

Schumer also noted that allowing banks to work with cannabis businesses would have some social equity benefits by enabling more low-income people to access capital, but that most benefits would go to the “fat cat, more well-to-do people, so you’ve got to be really careful about that.”

Nadelman went on to ask Schumer about the prospect of President Joe Biden getting on board with the majority leader’s cannabis legalization bill. Biden has only ever backed incremental cannabis reforms, such as federal decriminalization and state autonomy over marijuana policy, but is opposed to broader legalization. Schumer said the president had been very busy but that he intends to “lobby him heavily on this issue. And, you know, I’ve had a few conversations, but not many—but it will increase.”