IRS: Marijuana Banking Reform Would Help Feds ‘Get Paid’

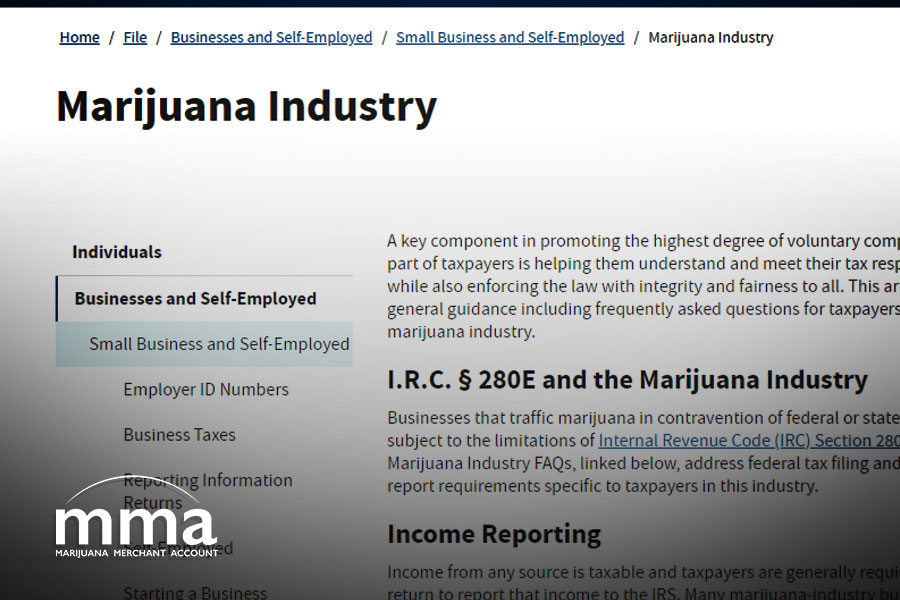

A top Internal Revenue Services (IRS) official said the agency’s job would be a lot easier if banks could offer their services to state-legal marijuana businesses without fear of federal reprisals. Susan Collins, who serves as senior counsel in the IRS Office of Chief Counsel, made the comments during an event organized by UCLA’s Annual