Cannabis represents a mutli-billion dollar industry and thousands of jobs in the U.S. but is excluded in all crisis responses, including COVID-19.

The pandemic has impacted every industry and the economy as a whole. Congress passed the Coronavirus Aid, Relief, and Economic Security (CARES) Act to offer support to U.S. businesses as shelter-in-place orders impacted commerce, but cannabis companies were barred from applying for these funds due to federal prohibition. Even companies that do business with cannabis companies may see their applications rejected.

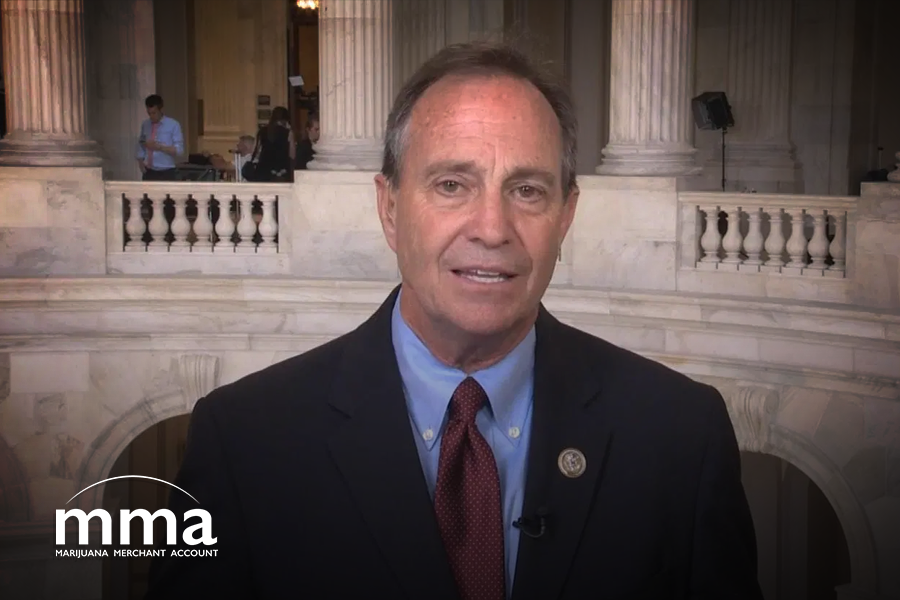

But it may not stay that way for Round 2 of economic relief. Congress had been considering the Secure and Fair Enforcement (SAFE) Banking Act before the pandemic, which would have clarified rules for banks and opened the doors for cannabis businesses to work with financial institutions. That bill had stalled in the senate, but proponent Colorado Congressman Ed Perlmutter (D) isn’t done trying. He has been working to see SAFE Banking Act provisions inserted into the next COVID-19 relief bill, which could make cannabis businesses eligible for relief funding.

With federal prohibition and unclear rules for financial institutions, many U.S. cannabis-related companies have thus far found it difficult to get an account with a bank or credit union. Access to those kinds of resources would be crucial to helping cannabis companies, especially smaller ones, stay afloat in these difficult times. Cannabis companies have had to rely on equity markets in the past and stock prices are at a low point right now, with several companies seeing a sharp decline in share value. That means having to sell more shares to more shareholders for the same amount of money.

To help open doors for cannabis companies to receive COVID-19 relief, Perlmutter and Oregon Congressman Earl Blumenauer introduced a bill on April 23 called the Emergency Cannabis Small Business Health and Safety Act. If enacted, cannabis companies would be able to access COVID-19 emergency funding resources and would prevent future relief packages from excluding cannabis. This only applies to cannabis companies in states where they are licensed and regulated.

But when will that help arrive for cannabis? Will it be soon enough? Most companies have thus far survived but are going to run out of cash soon, and the economy isn’t likely to bounce back to where it was immediately. Consumers are likely to have less discretionary funds to spend on cannabis than before.

For investors, these factors means they should be looking for companies that have high liquidity and a good cash flow. High growth and high profits over the last year are most ideal; higher risk investments look less appealing to investors right now, as the year ahead looks to be a challenging one that may see no relief.

—

What do you think of the proposed changes to the COVID-19 relief bill that would allow cannabis companies to apply? Is the SAFE Banking Act dead in the water, or does it still have a chance? Let us know what you think in the comments below.