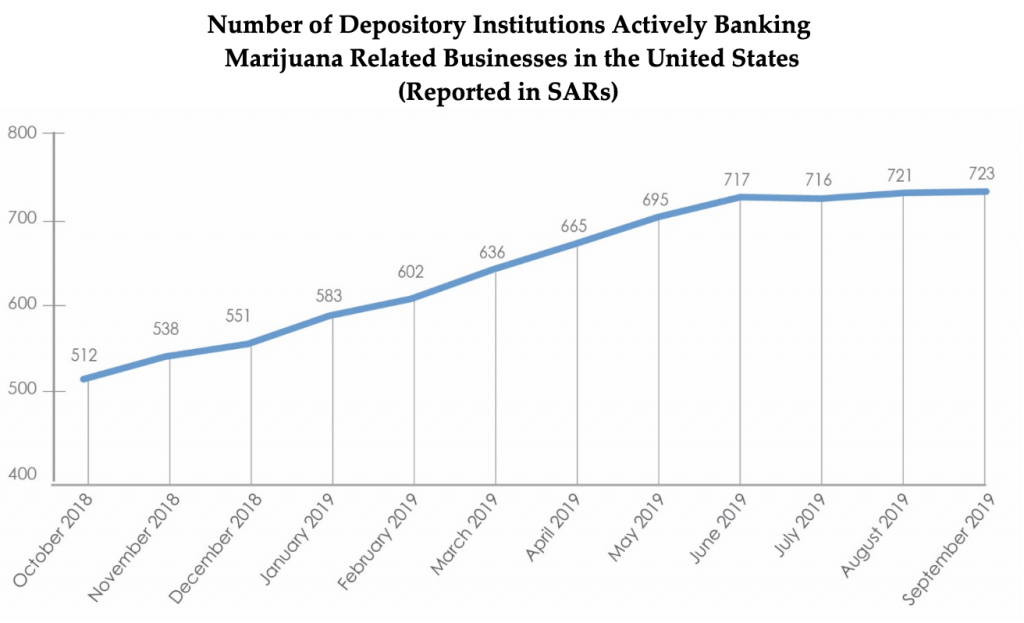

Financial institutions like banks and credit unions have been quietly getting in line to work with cannabis-related companies in the past few years, but the number signing up to offer these services seems to have leveled off, according to recent federal data. This shift could be a result of stalled legislation at the federal level that would clarify banking regulations.

Much hangs in the balance with the passage or failure of the Secure and Fair Enforcement (SAFE) Act. This bill would make it possible for more banks to work with cannabis-related businesses by reducing the paperwork burden and clarifying the rules for bankers. Financial institutions are taking a calculated risk when they choose to work with cannabis-related businesses, as they face the threat of major penalties from the federal level without the SAFE Act.

Were banks waiting to see what the U.S. House of Representatives did with the SAFE Act? If they were, they would have been disappointed, as the House declined to act on the measure before the summer break. Though the House has since passed the measure, it is still working its way through the Senate with its fate unclear. It faces uncertain opposition in a Republican-controlled delegation, even though cannabis banking and insurance has proven to be a bipartisan issue.

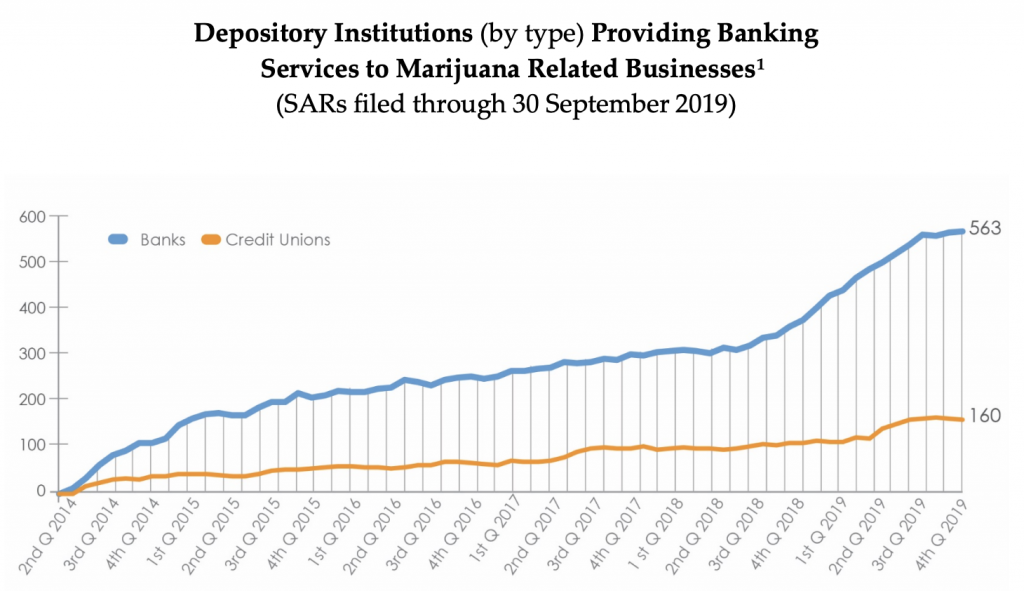

The Financial Crimes Enforcement Network (FinCEN) released a report recently for the recent quarter of 2019 that covered all “services to marijuana businesses” (SARs) through September 30, 2019. A total of 563 banks are working with cannabis-related businesses as of that date, as well as 1602 credit unions. While that is a slight uptick in banks from the prior quarter’s 553, the number of credit unions actually decreased by two. But the jump from March to June was much bigger, from 493 banks to 553, and 140 credit unions to 162.

The slow-down in banks signing up may in fact be a sign of hope from bankers: If the SAFE Act passes, that will be the perfect time to jump in to the cannabis market. Jumping in now would mean attempting to learn a system that may soon be replaced, and if bankers think that is likely, they are less likely to invest the time to dive in right now.

FinCEN tracks these numbers by the SARs that financial institutions file when working with cannabis-related businesses. A total of 102,807 SARs were filed as of September 30, though some SARs fall in more than one category. The breakdown of the SARs filed is as follows:

- About 74% were from state-licensed businesses

- About 7.6% were targeted for further investigation

- About 25% had their accounts terminated

This is the first time the number of SARs has totaled over 100,000 by the end of this quarter. Even with the trend potentially leveling out, there is still more business being done then ever before. But will banks continue to hold out for the SAFE Act? Bankers will have their answer by the end of the year if the bill is not passed, and efforts will have to begin anew to revive the measure in 2020.